The most popular wallets for cryptocurrency include both hot and cold wallets. Hot wallets are able to be connected to the web, while cold wallets are used for 10 basic stock investing tips » online finance degree keeping large amounts of coins outside of the internet. Just two months later, on January 3, 2009, Nakamoto mined the first block on the Bitcoin network, known as the genesis block, thus launching the world’s first cryptocurrency. Bitcoin price was $0 when first introduced, and most Bitcoins were obtained via mining, which only required moderately powerful devices (e.g. PCs) and mining software. The first known Bitcoin commercial transaction occurred on May 22, 2010, when programmer Laszlo Hanyecz traded 10,000 Bitcoins for two pizzas.

Keep in mind that in the world of investing, risks and potential returns often go hand in hand. Taking on higher risks might lead to greater potential returns, although it also raises the likelihood of losing your invested capital. For beginners, a software wallet, often referred to as a hot wallet, is generally recommended. This type of wallet is user-friendly and easily accessible through desktop or mobile applications. It also offers a familiar and convenient user experience, and usually comes with customer support. Getting started with cryptocurrency trading requires a thoughtful approach and careful preparation.

Individuals can create multiple exchange rate new zealand dollar to singapore dollar public addresses and distribute their collection of bitcoin over many addresses. A good strategy is to keep significant investments at public addresses, which aren’t directly connected to those used in transactions. As you venture into the realm of cryptocurrency trading, remember that learning is an ongoing process. Markets can be unpredictable, and cryptocurrency markets are particularly volatile. With continued learning, however, you are well on your way to become a better crypto trader with each practical trading experience you gain. Diversifying your portfolio is one of the most popular fundamental tools to reduce your overall investment risk.

How Is the Bitcoin Network Secured?

People often say that cryptocurrencies are decentralized, which is another way of saying that they are not controlled by a centralized entity. Essentially, you own your own digital wallet that gives you more freedom and control over your money. Unlike regular money from banks, cryptocurrencies aren’t controlled by any one big company or government. Instead, cryptocurrencies are like public digital record books that anyone around the world can see and keep a copy of. Bitcoin acts as a medium of exchange, a store of value, and a unit of account and is generally accepted as payment for goods and services.

While the idea that anyone can edit the blockchain might sound risky, it’s actually what makes Bitcoin trustworthy and secure. Since its public launch in 2009, Bitcoin has risen dramatically in value. Although it once sold for under $150 per coin, as of June 8, 1 BTC equals around $30,200.

What Is the Lightning Network?

- Deep cold storage is any cold storage method that is secured somewhere that requires additional steps to access the keys beyond removing a USB drive from your desk drawer and plugging it in.

- This network is powered by a blockchain, an open-source program that chains transaction histories to prevent manipulation.

- It provides insights into the open, close, high, and low prices of a cryptocurrency or financial asset over a specific time period.

- Futures and options are two common types of derivatives, and perpetual futures are a special type of futures contract unique to crypto markets.

This also generally involves a financial provider instantly converting your Bitcoin into dollars. In the U.S., people generally use Bitcoin as an alternative investment, helping diversify a portfolio apart from stocks and bonds. You can also use Bitcoin to make purchases, but there are some vendors that accept the original crypto.

Have an exit strategy

Because crypto is a nascent industry, regulatory developments can also have a significant impact on prices. These are tools that automatically make trades based on predefined trading indicators and parameters. They are available on some exchanges and trading platforms, and help traders avoid having to constantly monitor the market. Typically, the price consists of a fee-per-trade, plus the cost to convert a fiat currency to bitcoin. The fee-per-trade is a function of the currency amount of the trade, and, naturally, the higher the trade amount, the higher the fee. Although P2P exchanges don’t offer the same anonymity as decentralized exchanges, they allow users the chance to shop around for the best deal.

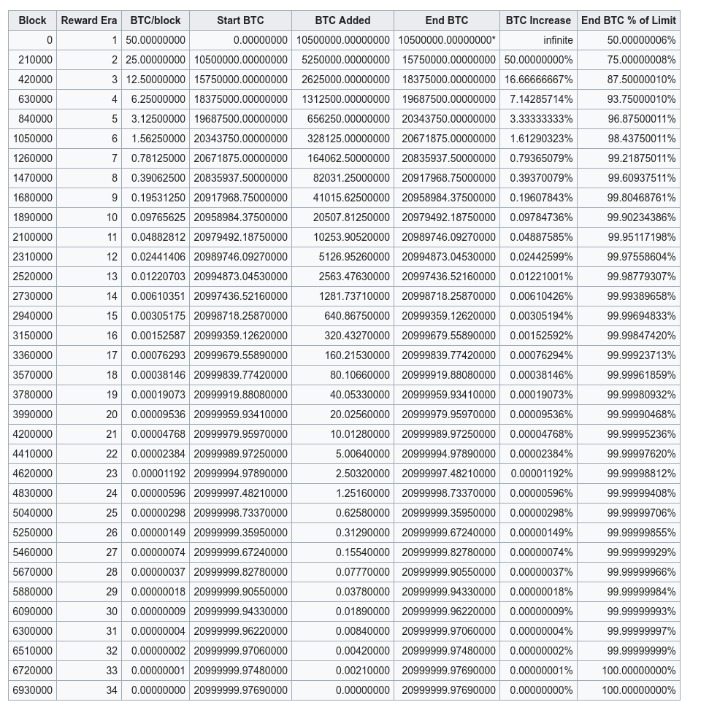

You should always use a reputable wallet provider, like from a registered cryptocurrency exchange. Read reviews and research wallets to ensure you’re choosing one that is reliable. All 21 million bitcoins will have been mined at that time, and miners will depend solely on fees to maintain the network. Mining is the process of validating transactions and creating a new block on the blockchain. Mining is conducted by software applications that run on computers or machines designed specifically for mining called Application Specific Integrated Circuits. Bitcoin makes money for investors through appreciation, the increase of an asset’s market value.

The Bitcoin Blockchain

The European Commission put its long-anticipated Markets in Crypto Assets legislation into force in 2023, setting the stage for cryptocurrency regulations in the European Union. Bitcoin is accepted as a means of payment for goods and services at many merchants, retailers, and stores. You can use your existing computer and mining software compatible with Bitcoin software and join a mining pool.

To send a coin, you enter the recipient’s address in your wallet application, enter your private key, and agree to the transaction fee. A wallet is a software application used to view your balance and send or receive bitcoin. The wallet interfaces with the blockchain network and locates your bitcoin for you. Because bitcoins are data inputs and outputs, they are scattered all over the blockchain in pieces because they have been used in previous transactions. Your wallet application finds them all, totals the amount, and displays it.

Bitcoin trading refers to the act of buying and selling Bitcoin via an exchange platform. The first way is to indulge in buying and selling of BTC on a cryptocurrency exchange. Another way of trading in Bitcoin is by means of derivative financial instruments, such as Contracts for Difference (CFDs). Trading via CFDs facilitates traders to trade as per the direction of market movement over the very short-term period and allows you to bet on Bitcoin price changes without actually owning any underlying coins.

A limit order is an order to buy or sell a crypto at a specific price or better. For example, if you want to buy one forex bullion and cfd broker bitcoin for $35,000 or less, you can set a buy limit order at $35,000. If the price drops to $35,000 or less, your limit order will be executed and you’ll purchase bitcoin at that price. But if the price never drops to $35,000, your order won’t be executed.

Their goal is to make a profit by selling those assets at a higher price in the future. There are many crypto trading strategies that you can employ, each with its own set of risks and rewards. As you become more comfortable with cryptocurrency, you can explore cold wallets that offer a different set of advantages and limitations. A cryptocurrency wallet is a digital tool that enables you to store, send, and receive digital assets.