If you file estimated quarterly taxes, you’re required to predict your income each year. Since the double declining balance method has you writing off a different amount each year, you may find yourself crunching more numbers to get the right amount. You’ll also need to take http://kilimandjara.ru/space/ilona-maska-vpechatlila-statya-rogozina-o-znachenii-poleta-crew-dragon/ into account how each year’s depreciation affects your cash flow. On the other hand, with the double declining balance depreciation method, you write off a large depreciation expense in the early years, right after you’ve purchased an asset, and less each year after that.

Why Is Double Declining Depreciation an Accelerated Method?

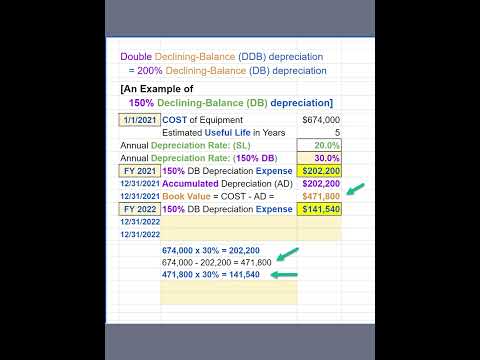

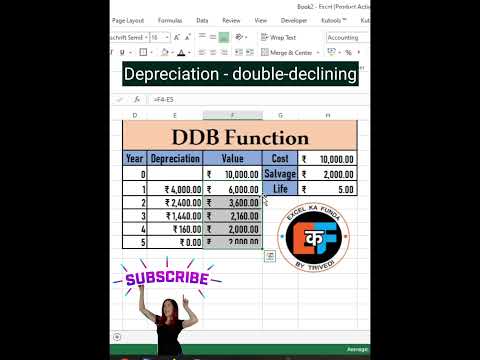

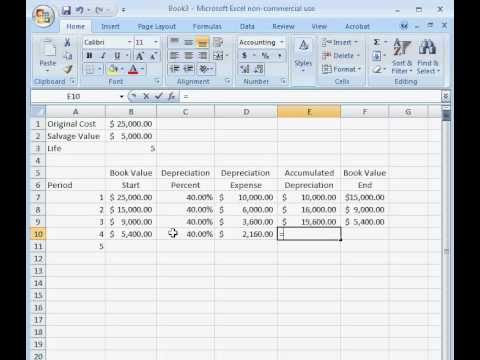

In contrast to straight-line depreciation, DDB depreciation is highest in the first year and then decreases over subsequent years. This makes it ideal for assets that typically lose the most value during the first years of ownership. You can calculate the double declining rate by dividing 1 by the asset’s life—which gives you the straight-line rate—and then multiplying that rate by 2.

Double Declining Balance Depreciation Method: Recap and Final Thoughts

The account balances remain in the general ledger until the equipment is sold, scrapped, etc. Is a form of accelerated depreciation in which first-year depreciation is twice the amount of straight-line https://giraffesdoexist.com/ru/content/article/rar-winrar-isklyuchit-podpapki-poddirektorii-iz-arhiva depreciation when a zero terminal disposal price is assumed. The arbitrary rates used under the tax regulations often result in assigning depreciation to more or fewer years than the service life.

Double-Declining Balance (DDB) Depreciation Method Definition With Formula

In the above example, we assumed a depreciation rate equal to twice the straight-line rate. As an alternative to systematic allocation schemes, several declining balance methods for calculating depreciation expenses https://sevsovet.com.ua/ru/2017/09/vliyanie-marketinga-na-okupaemost-investicij-internet-proekta/ have been developed. An asset’s estimated useful life is a key factor in determining its depreciation schedule. In the DDB method, the shorter the useful life, the more rapidly the asset depreciates.

The steps to determine the annual depreciation expense under the double declining method are as follows. If you’ve ever wondered why your shiny new car takes a huge value hit the first few years you own it, you’re not alone. This form of accelerated depreciation, known as Double Declining Balance (DDB) depreciation, is actually common method companies use to account for the expense of a long-lived asset. However, when it comes to taxable income and the related income tax payments, it is a different story.

Declining Balance Method of Assets Depreciation

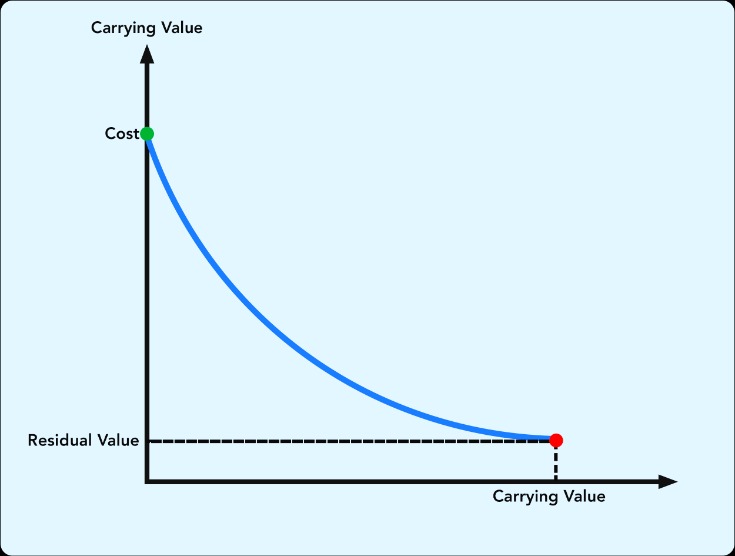

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. This is when that year’s depreciation is limited to the amount that will reduce the asset’s book value to its residual value.

- This cycle continues until the book value reaches its estimated salvage value or zero, at which point no further depreciation is recorded.

- This accelerated rate reflects the asset’s more rapid loss of value in the early years.

- Nevertheless, businesses should carefully evaluate their specific circumstances and asset types when choosing a depreciation method to ensure that it aligns with their financial objectives and regulatory requirements.

- For the second year of depreciation, you’ll be plugging a book value of $18,000 into the formula, rather than one of $30,000.

- All methods of depreciation can affect a business’s tax picture and taxes owed.

What Does the Declining Balance Method Tell You?

However, the final depreciation charge may have to be limited to a lesser amount to keep the salvage value as estimated. An exception to this rule is when an asset is disposed before its final year of its useful life, i.e. in one of its middle years. In that case, we will charge depreciation only for the time the asset was still in use (partial year). Like in the first year calculation, we will use a time factor for the number of months the asset was in use but multiply it by its carrying value at the start of the period instead of its cost. Since the assets will be used throughout the year, there is no need to reduce the depreciation expense, which is why we use a time factor of 1 in the depreciation schedule (see example below).

The Double Declining Balance Method has several advantages:

Since we’re multiplying by a fixed rate, there will continuously be some residual value left over, irrespective of how much time passes. Depreciation is an accounting process by which a company allocates an asset’s cost throughout its useful life. Firms depreciate assets on their financial statements and for tax purposes in order to better match an asset’s productivity in use to its costs of operation over time. Depreciation rates used in the declining balance method could be 150%, 200% (double), or 250% of the straight-line rate.

The declining balance method is also known as the reducing balance method. It’s ideal for assets that quickly lose their value or inevitably become obsolete. This is classically true with computer equipment, cell phones, and other high-tech items that are generally useful earlier on but become less so as new models are brought to market. An accelerated method of depreciation ultimately factors in the phase-out of these assets.